The Merge is coming soon. Ethereum will transition from proof-of-work to proof-of-stake, improving its security and sustainability. Still, questions linger about what the Merge actually does, how it impacts various stakeholders, and when it will actually arrive. This report covers the current state of the Merge, key implications leading up to and after the Merge, and a range of measures to gauge market sentiment.

Quick Takes

The Merge significantly changes Ethereum’s monetary policy with a ~90% reduction in ETH issuance. For 6–12 months, validators’ principal (32 ETH) and new issuance will also be illiquid and stuck on the Beacon Chain. Circulating ETH supply may significantly contract through deflationary monetary policy and increased demand for staking ETH.

Commentary from the Ethereum community suggests a soft target for the Merge in September. A range of market measures suggests that the market is expecting the Merge to at least happen by year-end. Pricing on Binance rates suggests that the market expects the Merge to occur by end of September.

Ethereum MEV changes after the Merge. Most validators will run MEV-boost — free, open-source software that democratizes access to MEV rewards. But validator pools and centralized entities will likely continue to gain validator market share in the near term due to several factors (MEV smoothing, multi-block MEV potential, DoS mitigation). Ethereum developers are working on solutions to fix this on the protocol level.

Miners have been key stakeholders of Ethereum since inception. Kicking them out is tough. Ethereum Classic, the largest GPU mineable blockchain after the Merge, cannot handle the influx of Ethereum’s hashpower. Facing a lack of alternatives, some miners have signaled support for an ETHPoW fork. We expect that a fork might cause a lot of headlines but would have negligible value in the long term.

Current State of the Merge

Two live testnets, Ropsten and Sepolia, have been successfully merged. In addition, there have been ten largely successful shadow forks on mainnet. These practice runs have exposed multiple small bugs that have been mostly fixed. Goerli will be the last testnet to undergo the Merge, which is expected to occur around August 6 to 12.

If all goes well, the mainnet Merge is expected around the week of September 19. But this is not a set date. The timeline, proposed by Tim Beiko on an Ethereum Consensus Layer Call, is a soft target and not final. Furthermore, estimating the Merge timing is difficult. The Merge activated more quickly than expected on testnets. Nonetheless, the proposed timeline below serves as a good rough approximation.

Note: Goerli Merge has been revised to be slightly earlier after this publication

What the Merge Does and Does Not Do

What the Merge Does and Does Not Do

The Merge will not materially increase transaction throughput and reduce gas fees. It simply changes the consensus mechanism from proof-of-work (PoW) to proof-of-stake (PoS). Fees will be slightly lower, all else being equal, as block production rate will be improved from ~13 seconds to 12 seconds.

Staked ETH cannot be withdrawn after the Merge. Withdrawals of staked ETH and new ETH issuance on the Beacon Chain will be enabled after the Shanghai hard fork, which is estimated to activate 6–12 months after the Merge. However, fees from transaction tips and MEV will be immediately liquid post-Merge. We clarify how withdrawals work later in this report.

The Merge does not enable on-chain governance. Some PoS blockchains have on-chain governance where their rules and upgrades are governed using some form of on-chain voting (examples include Cosmos and Polkadot). But this is not the case for post-Merge Ethereum. Similar to Bitcoin or the current version of Ethereum, protocol changes are discussed and decided upon off-chain through the social layer with a wide range of stakeholders.

The Merge does not mean there is free money for stakers. Under PoW, the Ethereum protocol has to provide enough incentives to compensate miners for operational expenses and a slim margin on top of that. A common take is that, by transitioning to PoS where validators have virtually no ongoing costs, stakers can enjoy easy high yields.

But staking is not free. Validators have opportunity costs on capital, both in choosing to invest their money in ETH and in staking their ETH in the Beacon Chain compared to other ETH yields. If staking were free, people would continue to acquire and stake more capital until a similar equilibrium point. In fact, this played out with the leveraged stETH trade that unwound in May-June. We explain this dynamic in more detail below.

The Merge significantly alters Ethereum’s monetary policy. Ethereum is currently rewarding both miners (at a rate of 2 ETH per block) and validators on the Beacon Chain. After the Merge, rewards to miners will cease, resulting in a ~90% reduction in ETH issuance — termed “the triple halving”. We explore this dynamic more deeply in the section below.

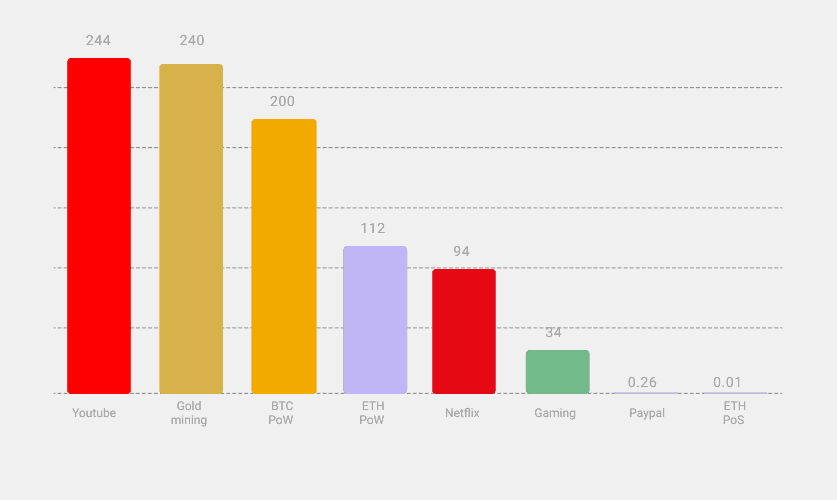

The Merge drastically reduces Ethereum’s energy expenditure and carbon emission. Under PoW, entities acquire energy-intensive mining equipment to secure the Ethereum network, resulting in high electricity use and hardware waste. Ethereum’s current energy consumption is on par with the power consumption of Chile; its carbon footprint similar to that of Hong Kong.

After the Merge, entities stake collateral to secure the network. There is no more arms race in acquiring more powerful mining hardware, significantly reducing energy expenditure. Most estimates suggest that Ethereum’s energy consumption will be reduced by over 99.95%.

Estimated Annual Energy Consumption (TWh/yr)

Source: Ethereum.org, Digiconomist

In Focus — Key Areas

“The Triple Halving”

The Merge is anticipated to significantly alter capital flows into and out of the Ethereum ecosystem.

On the supply side, Ethereum is currently incentivizing both miners (under PoW) and validators (under PoS). Seignorage is paid to miners to produce new blocks at 2ETH per block, and rewards are also being distributed to validators on the Beacon Chain. After the Merge, rewards to miners will cease, reducing ETH’s issuance rate by ~90%. This is why the Merge is also colloquially termed the “triple halving” — a nod to Bitcoin’s halving cycles.

Ethereum can afford to reduce ETH issuance because PoS is a more efficient way to secure a network compared to PoW. Under PoW, Ethereum needs to issue enough ETH to cover miners’ costs (purchasing mining rigs and paying for electricity) along with a slim margin. Under PoS, Ethereum only needs to cover the opportunity cost of capital. Furthermore, whereas PoW can only incentivize correct behavior miners through rewards, PoS allows Ethereum to also disincentivize misbehavior through slashing.

Ethereum Will Be Deflationary After the Merge

Source: Ultrasound.money

Demand for Ether is also expected to increase after the Merge due to a number of factors. First, staking rewards for validators will immediately increase. Validators will receive transaction tips that are currently earned by PoW miners, potentially boosting APRs by ~2–4%. Furthermore, they will also begin to earn MEV (maximal extractable value) due to their ability to reorder transactions. Researchers at Flashbots, an R&D organization that studies the emergent behaviors of MEV, suggest that validator yields could increase an additional 60% due to MEV (assuming 8M staked ETH). Therefore, if the Merge happened today, validators could expect to earn a total of ~8–12% APR due to all the factors mentioned above.

Total Staking Yield if the Merge Happened Today

Note: Estimate of MEV rewards are conservative as it is a lower-bound estimate from Flashbots

Source: @StakeETH, @eth2calculator, Etherscan, Beaconcha.in, Flashbots

Of course, these yields are not sustainable. Therefore, we expect a significant increase in ETH to be staked after the Merge. If the proportion of staked to total ETH is comparable to those of alternative L1s (Solana and Tezos: 75%, Cosmos: 64%, NEAR: 39%), Ethereum staking yields would compress to below 2% APR. Readers can evaluate how staking rewards would play out under varying scenarios in this calculator.

Total Post-Merge Staking Yield Sensitivity Analysis

Source: @StakeETH, @eth2calculator, Etherscan, Beaconcha.in, Flashbots

Other near-term factors that is expected to affect ETH’s demand-supply include:

ETH de-risks after successfully transitioning from PoW to PoS

Removal of energy usage criticisms as network energy expenditure will drop by >99%

ETH will be increasingly seen as a financial instrument, similar to equity or a perpetual bond, due to its staking rewards

Withdrawals from the Beacon Chain will not be enabled until the Shanghai hard fork, slated to be activated 6–12 months after the Merge

Stuck Until Shanghai

Withdrawals from the Beacon Chain are commonly misunderstood. Withdrawals of staked ETH and new ETH issuance on the Beacon Chain will not be enabled at the Merge. Instead, it will be enabled in the Shanghai upgrade, tentatively scheduled to occur 6–12 months after the Merge.

However, priority fees and fees from MEV (which could make up over half of total staking rewards) will be available for withdrawal immediately after the Merge.

Capital Outflow After the Merge?

Two separate withdrawals will be allowed after the Shanghai hard fork. First are partial withdrawals — allowing active validators to withdraw accumulated rewards and bringing down the balance of their stake back to 32 ETH. These are important as it allows validators to withdraw the income that they have generated without fully shutting down and reactivating their validator. It also allows validators to maximize efficiency, as when the balance of a validator goes above 32 ETH, there is no gain of efficiency in excess tokens. Without partial withdrawals, the earned rewards would sit as idle capital.

The maximum number of partial withdrawals per epoch is currently set at 256. Each day comprises 225 epochs, so 57,600 validators can withdraw their rewards every day. Currently, the average balance of all active validators is 33.66 ETH. We could expect this figure to climb to near 34 ETH at the time of the Shanghai upgrade, which suggests that the market would see partial withdrawals of:

(34–32) x (57,600) = 115,200 ETH per day

(~$173mn if ETH = $1,500)

This could continue to flow for between 7 days (based on the current validator set of 410k) to as high as 14 days (if the validator set increases to 800k).

Validators could instead opt for full withdrawals. Full deposits and withdrawals are limited per epoch to ensure the security of the Ethereum network, currently set at around 6 per epoch. To put this number in context, if all active validators currently wanted to withdraw, it would take over a year.

We expect that most of the rewards collected from partial withdrawals will be to create new validators instead of selling into the market, and that demand for new deposits will outweigh potential sell pressure from full withdrawals. Nonetheless, we point this dynamic out as it operates differently from alternative PoS-based blockchain networks and acts as a source of confusion.

The Upshot

90% reduction in ETH issuance

For 6 months to a year, validators’ principal (32 ETH) and issuance rewards will be illiquid and stuck on the Beacon Chain

Circulating ETH supply may continue to reduce through deflationary monetary policy and demand for staking ETH

Building Blocks

MEV has grown from a niche topic just a few years ago into a focal point of blockchain research today. MEV impacts all areas of the blockchain, from creating points of centralization to affecting user experience. The full impact of MEV is beyond the scope of this report — instead, we will briefly touch on how MEV affects validators post-Merge.

Maximal Extractable Value, or MEV, broadly refers to the total amount a miner or validator can increase their balance across a series of blocks given the actions available to them. These actions can include the ability to reorder transactions, censor blocks, and even attempt to reorg the chain. Some common forms of MEV include sandwich attacks, arbitrage, and liquidations.

The History and Current State of MEV

In the current state of Ethereum, most users send their transactions into a public mempool via their wallets. Entities called searchers constantly monitor the mempools for potential profit opportunities. In the early days of MEV, searchers captured these opportunities by bidding high gas prices for their transactions to have their transactions prioritized.

Naturally, as MEV became more competitive, this resulted in priority gas auctions (PGAs) that increased network load, created volatile gas prices, and inefficient usage of blockspace. Other negative externalities arose. Teams began building infrastructure across to world to offer quicker and broader access to various mempools. Miners offered services that allowed searchers to bypass the public mempool and execute transactions in private. Cartels between searchers were formed to prevent over-bidding for MEV strategies.

Several solutions arose to mitigate these negative externalities. Most prominently, Flashbots. Amongst other things, they created a sealed-bid auction mechanism for blockspace that allows searchers to privately bid for blockspace without paying for failed bids. Mining pools that plug into Flashbots infrastructure collect all these bids and produce a block that maximizes their revenue.

This largely democratized MEV. Searchers that found unique MEV opportunities could avoid revealing their strategy to other searchers and capture most of profit. For more competitive strategies (such as arbitrage), miners have democratized access to MEV revenue via the bids that searchers submit.

Post-Merge MEV

Validators will replace miners after the Merge. But there is no built-in mechanism at the protocol level to help validators capture MEV. Left unchecked, this structure would allow professional firms and larger entities to better capture MEV by setting up multiple validators and strategies that build optimal blocks. At-home validators would not be able to compete effectively.

Fortunately, Flashbots has also created a post-Merge alternative called MEV-boost. MEV-boost allows validators to auction off their blockspace to an open market and maximize their staking rewards.

The MEV Supply Chain

Source: Flashbots

In this framework, searchers will continue to find profit opportunities from MEV and bid for their bundles to be included. Builders aggregate all these bundles to build the optimal full block which pays the highest. When it is a validator’s turn to propose a block, they query the MEV-Boost relay for a payload that pays the highest and includes that in their proposed block. (We glossed over a lot. Reach out to us if any questions.)

However, there will be variability in MEV rewards. For instance, periods of high volatility often lead to higher MEV fees. Validators who luckily get to propose during these periods will likely see higher MEV rewards. A Flashbots study last year confirmed that the inequality between validators is exacerbated after factoring MEV.

Inequality Between Validators Without MEV (Left) and With MEV (Right)

Note the distance between the green and red lines significantly widens with MEV extraction

Source: Flashbots

Consequently, large institutions and validator pools that can socialize/smooth MEV by running thousands of validators benefit. This dynamic is similar to why at-home GPU miners join mining pools today — stability and predictability of income. The potential for multi-block MEV is a further centralizing force.

Validator Distribution by Staking Pool

Source: Beaconcha.in

Until Ethereum has MEV smoothing built into the protocol layer (something that is currently being worked on), validator pools and centralized entities will likely continue to gain market share.

Miners, Forks, Etc.

Miners are a critical part of Ethereum’s ecosystem. They have collectively spent an estimated $15 billion on GPUs. After the Merge, all their equipment and infrastructure will be idled and look for alternative uses. Already, GPU resale prices have halved from the beginning of this year in anticipation of the Merge.

Thus, what miners do leading up to and after the Merge remains highly uncertain. Some arguably adversarial behavior has already been observed. In May, developers had to re-do testing the Merge on Ropsten, after a miner significantly increased the hashrate to hit TTD before the Ropsten Beacon Chain was live.

The rationale, In the miner’s words, is that “IT’S A STRESS TESTING ROPSTEN NETWORK TO SEE WHAT WOULD HAPPEN IF THE MERGE HAPPENED OUT OF SCHEDULE.”

Sudden Spike in Ropsten Hashrate Caused by a Miner

Source: bordel.wtf

It is possible that leading up to the Merge, miners will become more hostile and severely degrade the user experience on Ethereum.

For instance, miners could steal MEV. When searchers send bundles to miners via Flashbots, searchers are trusting that the miners will not steal/expose/front-run the strategy. There is no cryptographic guarantee that miners won’t steal a bundle. As the Merge nears, miners could begin doing so as the cost of getting caught decreases.

Miners could also theoretically start running clients that reorg the Ethereum blockchain to retroactively capture MEV. These tools have been proposed in the past and largely frowned upon by the community. Large mining pools have not adopted them primarily due to reputation and harming the Ethereum network.

We expect that the largest mining pools such as Ethermine will not engage in malicious behavior. F2pool, the second largest mining pool, has already been planning for the Merge for a long time with its sister company, Stakefish. Ethermine also launched a beta staking pool service.

Nonetheless, smaller miners may attempt to eke out as much revenue as possible before the Merge by behaving maliciously.

Where Will Miners Go?

After the Merge, if these machines attempt to rotate within the crypto ecosystem, the most likely candidate would be Ethereum Classic, a fork of Ethereum resulting from the DAO hack in 2016. Just this week, Antpool, the eighth largest Ethereum mining pool, pledged a $10 million investment to develop the Ethereum Classic ecosystem.

But daily fees for Ethereum Classic are multiple orders of magnitude smaller than Ethereum. No other altcoins come close. Furthermore, the profitability of mining these networks will inevitably shrink if miners flood them with GPU hashrate, especially if prices do not rise.

GPU Mineable Blockchains

Clearly, other GPU mineable blockchains cannot handle the influx of idled GPU after the Merge. Furthermore, Bitpro estimates that for GPU miners to stay profitable within the crypto ecosystem, around 95% of GPUs need to be shut off. It is unlikely that this immediately happens after the Merge.

Thus, there is a possibility that miners attempt to maintain a PoW fork after the Merge. Some miners have already gathered support for an ETHPoW fork. If some exchanges support a fork, and a small group of miners continues a fork, a fork could live on longer than anticipated.

Even if that happens, virtually all users and developers will stick with the canonical, PoS Ethereum. There is no meaningful philosophical or ideological support for an ETHPoW fork. Furthermore, Ethereum’s ecosystem is drastically different now compared to 2016 (when the ETH / ETC fork happened). Real-world asset issuers, such as Circle (USDC) and Tether (USDT), will support minting/redemptions only on the canonical chain. Wrapped assets, such as wBTC, will do so as well. L2s and bridges will also only honor assets bridged from the main chain. DeFi on top of an ETHPoW fork becomes a bizarre situation in which billions of assets are rendered useless overnight.

Therefore, we expect that a fork might cause a lot of headlines but would have negligible value in the long term.

Priced In?

Liquid Staking Derivatives

Liquid staking derivatives can serve as a gauge of sentiment. The largest three are Lido’s (stETH), Binance’s (bETH), and Rocket Pool’s (rETH).

stETH and bETH are rebasing tokens — token balances are pegged 1:1 to the ETH staked and token balances are periodically updated to reflect rewards. Thus, stETH and bETH should converge to the price of 1 ETH after the Shanghai hard fork, as users will be able to arbitrage between ETH and their liquid staking derivatives afterward.

In contrast, rETH is designed as a value accrual token. It acts like a claim to the network’s total staked ETH and rewards. Therefore, the rETH-ETH exchange rate will increase over time. However, trading back rETH to ETH depends on protocol liquidity, which is limited until withdrawals are enabled. As a result, the market price of rETH has fluctuated over the past year.

Price Performance of Liquid Staking Derivatives

Before this May, stETH traded mostly on par with ETH, as there was high demand for staking ETH. This was further reinforced by the (incorrect) idea that stETH is “pegged” to ETH in the same way that 1 USDC is pegged to 1 USD, which gave market participants the confidence to leverage their yields. In this trade, participants would deposit their stETH in a money market protocol (most commonly, Aave) as collateral to borrow ETH, stake the borrowed ETH to receive stETH, and loop the trade again.

Several Products Emerged to Offer Leveraged ETH Staking

Turbulent market events starting in May forced large market participants, notably Celsius and Three Arrows Capital, to sell their stETH collateral. The lack of stETH-ETH liquidity and a crowded leveraged trade resulted in a lot of people trying to exit through a small door.

Crowded Trade Heading Through the Same Door

What The Market is Pricing In

bETH is currently trading at a 2.2% discount from ETH whereas its “flexible” staking yield is 2.4%.

If we were to treat bETH as a zero-coupon bond that is redeemable for 1 ETH when withdrawals are enabled; with the alternative yield at 2.4%, we can think of the market as ‘pricing’ the Shanghai upgrade to occur ~335 days from now.

Developers have guided that the Shanghai hard fork occurs 6–12 months after the Merge. Assuming the mid-range of these estimates, this implies the Merge to occur around September 30, 2022.

Needless to say, taking into account liquidity considerations and market technicals, this approximation is far from perfect but can be used to gauge market sentiment. The same exercise could be run for stETH, but we use bETH and Binance’s flexible earn rate to exclude the impact of counterparty risk and more easily back out the opportunity cost of capital.

ETH/BTC

The ETH/BTC ratio is also often used as a sentiment gauge for Ethereum while stripping out broader macro moves that may affect overall crypto prices. Major crypto events since May — such as Terra and Three Arrows Capital — muddies the pictures as there was allegedly forced selling of either asset over the period. However, ETH/BTC has rallied 20–30% since the beginning of July, spurring further Merge narratives.

Merge Beneficiaries

Price performance of some publicly traded tokens benchmarked against ETH also provides another glimpse into market sentiment.

Some beneficiaries of the Merge include:

Most of the tokens in the above categories have strongly outperformed against ETH since June with a couple of exceptions.

Price Performance of Select Tokens (Benchmarked to ETH)

Polymarket

Polymarket has the largest prediction market for the Merge. Although liquidity is incredibly low, diluting its predictive power, it nonetheless offers an alternative, simpler way of gauging market sentiment for the Merge.

Currently, Polymarket participants are giving a 66% probability that the Merge will happen according to the proposed timeline and a 95% probability that the Merge will occur by the end of this year.

Risks of the Merge

Execution risks. Good communication among all stakeholders is critical to a successful Merge. Validators on the Consensus Layer need to perform multiple actions prior to the Merge, such as updating the correct TTD value and keeping their nodes updated and in sync. User error or misinformation could cause nodes to drop off. Clients for the Consensus Layer may also have undiscovered bugs (although this is unlikely given the amount of testing put into various clients). If enough nodes fail, Ethereum could temporarily halt. There also exists execution risks for applications or exchanges running on top of Ethereum.

The Ethereum community has been actively working to mitigate these risks. For instance, the community rallied together to improve client diversity, reducing Prysm’s validator share from over 68% in April to 41% today. As a result, the consequences of a potential bug are significantly reduced — if a client had a bug with over 66% validator share, then validators cannot return to the real chain without being slashed.

Miner Risks. As mentioned in the above section, miner incentives will change leading up to and after the Merge.

Validator Risks. After the Merge comes a new set of network risks. A significant one is potential Denial of Service (DoS) attacks. Proposers will be known in advance and there will be incentives for some actors to maliciously DOS a validator. This also acts as a centralizing force that favors institutional validator pools that can handle and mitigate DoS risks.

Complexity Risks. Ethereum will effectively merge two separate networks together, expanding technical complexity. To participate on the Beacon chain, individuals need two clients. To run a validator, they need three. To capture MEV rewards, they need four. The risk is that, as Ethereum modularizes and specializes, this trend continues to a point where specialization occurs and it is difficult for any one person to understand the full picture.

Vitalik has also addressed this in his recent EthCC talk, rallying the community to start thinking about reducing Ethereum’s complexity.

Vitalik’s Ideal Long-Term Goal (for complexity, not price)

Conclusion

Appendix I: Overview of Select Tokens

Appendix II: Keeping Track of the Merge

Difficulty Bomb

The difficulty bomb, implemented in 2016, gradually increases the difficulty of mining new blocks such that it eventually grinds to a halt. It was introduced to guarantee a transition to PoS. The difficulty bomb has been pushed back six times, most recently in the Glay Glacier upgrade. Barring any surprises, we expect the difficulty bomb will not be pushed back anymore, so there will be a greater focus on average block times as we near the Merge.

Other Resources

All Core Devs meetings are where various Ethereum teams discuss the future direction of Ethereum. Tim Beiko and Christine Kim often give excellent summaries of these calls on Twitter.

Ethereum developers maintain a “Merge Mainnet Readiness Checklist” that periodically updates after major milestones on Github.

wenmerge.com keeps track of a difficulty bomb countdown and major milestones on the path to the Merge.

Disclaimer

The information contained in this post (the “Information”) has been prepared solely for informational purposes, is in summary form, and does not purport to be complete. The Information is not, and is not intended to be, an offer to sell, or a solicitation of an offer to purchase, any securities. The Information does not provide and should not be treated as giving investment advice. The Information does not take into account specific investment objectives, financial situation or the particular needs of any prospective investor. No representation or warranty is made, expressed or implied, with respect to the fairness, correctness, accuracy, reasonableness or completeness of the Information. We do not undertake to update the Information. It should not be regarded by prospective investors as a substitute for the exercise of their own judgment or research. Prospective investors should consult with their own legal, regulatory, tax, business, investment, financial and accounting advisers to the extent that they deem it necessary, and make any investment decisions based upon their own judgment and advice from such advisers as they deem necessary and not upon any view expressed herein.

On the Merge was originally published in Amber Group on Medium, where people are continuing the conversation by highlighting and responding to this story.